|

A-Z ELECTRICITY INDEX

Please use our A-Z INDEX to navigate this site where page links may lead to other sites

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FREE AS A BIRD - It is happening. Wind energy is providing bucket loads of power that will be more useful with the kind of load leveling that battery and green hydrogen storage can provide, to make better use of all that captured natural muscle. Windmills and sails had been working for mankind for hundreds of years before the discovery of electricity. These graceful machines can be located in isolated areas where winds are strong and reliable. Making allowance for storms, doldrums, and power blackouts, by design.

ENLIT EUROPE - Was Scheduled to be held in Milan, Italy between the 27 and 29th of October 2020. Since then, nothing has changed in terms of load levelling or uninterruptible power supplies. It is as if power supply corporations have seized up on the innovation front. Some succumbing to the lure of coal, other nuclear power.

ELECTRICITY POWER COMPANIES A - Z

According to Power-Technology.com, a website that provides market and customer insights in this sector, they listed these power companies (according to the 2018 Forbes calculation of net market capitalization, assets, sales and profit) as the biggest utilities:

Duke Energy Corporation, DUK, N. Carolina, USA Dominion Energy Inc., Richmond, Virginia Exelon Corporation EXC, Chicago, USA KEPCO Korean Electric Power Corporation National Electric Grid & Central Electricity Authority (India) National Energy Board (Canada) National Grid plc (formerly Central Electricity Generating Board UK) Next

Era Energy Inc. Florida, USA Southern Company, Atlanta, Alabama, Georgia, Mississippi, USA State Grid Corporation of China TEPCO Tokyo Electric Power Company

SMARTNET - EV LOAD LEVELLING

The developers of the SmartNet EV system propose working with generating utilities to encourage responsible operational increases based on a forecast of uptake - to help expand their clean (renewable) energy sector more quickly in the interests of reducing global warming and providing affordable electricity and lower cost electric mobility all over the world.

By eliminating fossil fuel generating stations, for example, coal fired, the United Nations' Sustainability Development Goals (SDGs) might be achieved the aim being for a transition to 100% electricity as soon as possible.

Those companies collaborating on such proposal(s) are sure to increase operational efficiency and profits for their investors, especially in capitalizing on load-leveling stations to make best use of intermittent solar and wind generation.

According to Investopedia, 3% to 4% is the average dividend yield offered by top companies in the utility sector, which has been traditionally known to offer a high dividend payout.

VEHICLE END USERS

The general public can only make use of vehicles that are sold by car companies, and service facilities that exist to provide fuels and other garage services. Our objective is to be able to demonstrate that the technology exists to allow the general public to swap their petrol and diesel steeds for clean electrics, without sacrificing convenience.

Auto makers then owe a duty of care to their fellow man and planet earth, to produce vehicles that do not produce harmful emissions and provide such convenience. In our view, petrol and diesel vehicles should have carried Government health warnings since the World Health Organization declared particulates harmful from 2013. The shameful lack of action on the part of the G20 has caused unnecessary human suffering and deaths.

The solution demands confidence in the vehicles that are being sold. Such confidence may only be provided by EV service stations to equal the convenience of liquid fossil fuel stations. This level of convenience is the basis of our Business Plan. It was sadly lacking in 2020 due to funding shortfalls for innovation, where current calls are based on straight line development, with no allowances for lateral thinking.

But in 2022, they still have no solution to power cuts and blackouts, causing major disruption in the modern age of electricity - putting the lives of young, vulnerable and infirm at risk. Also raising the question of this company failing to meet Paris climate objectives aimed at Net Zero - where reliability is a key factor in reaching United Nations' Sustainability Development Goals. Especially SDG7 clean, affordable energy for all, and SDG17, partnerships, such as with automotive OEMs, where the supply of energy for transport is their responsibility, as much as motor manufacturers have a duty to provide zero emission vehicles (ZEVs) - meaning electrics, as a solution that has finally come of age. But where is the infrastructure to make this happen?

Power companies and automotive OEMs need to work together urgently, if they are going to stand any chance of catering for EVs by 2050. They have no chance at all at present levels of cooperation and forward planning - of meeting the targets set for 2030 by policy makers. They are far too comfortable, knowing they can give politicians the run around with manifold excuses from spin doctors - who are employed by climate deniers - to keep burning carcinogenic coal, diesel and petrol.

In the process, they are making their countries vulnerable to suppliers of energy who have grown wealthy enough from fossil fuel exports, to wage war in 2022.

CLIMATE

CHANGE COMMITTEE (UK) - POWER SECTOR

Fundamental reform of the electricity market has taken place since the Climate Change Act 2008 was passed, in line with the CCC’s recommendations. This includes the introduction of long-term contracts for the generation of low-carbon electricity and a shift to competitive approaches when allocating contracts, these have supported dramatic reductions in the cost of renewable power (for example, costs of contracted new-build offshore wind power has fallen by over 50% from 2015 to 2017.

The proportion of electricity generated from renewables has also increased from 12% in 2012 to 30% in 2017. Long-term contracts have allowed construction to begin on the first new nuclear power plant in a generation.

The introduction of a UK ‘carbon price floor’ has put a minimum price on emissions from the power sector. This has helped to drive the transition away from coal to lower-carbon sources of energy – in May 2019 the UK was powered for a two week period without burning coal.

No new coal-fired power stations have been built since the Climate Change Act was passed, in line with the CCC’s recommendation that new coal plants should only be built if they include technology to capture carbon dioxide emissions, known as Carbon Capture and Storage.

The Government has supported the conversion of existing coal plants to use biomass (burning wood, plants, food waste and other biological matter), instead of investments in new dedicated biomass plants, in line with CCC advice in 2011. The Government has also tightened the sustainability limits for use of biomass in line with the Committee’s advice to 200gCO2/kWh in 2020, moving towards 180gCO2/kWh in 2025, ensuring that bioenergy will become an increasingly clean source of fuel.

Funding of the ‘Levy Control Framework’, which sets a cap on Government subsidies to support renewable energy generation, was set in line with the CCC’s advice at £7.9 bn in 2020/21. Funding for offshore wind and other emerging technologies has been extended to the mid-2020s helping to support investors in developing projects and cutting costs.

The Committee identified offshore wind as a strategic priority for the UK in its 2011 Renewable Energy Review with potential for significant cost reduction and to provide a major contribution to the UK’s low-carbon future. Offshore wind is on track to provide over 10% of UK generation by 2020 with the UK having the largest installed capacity in a growing global market. Offshore wind costs for contracted new-build projects have plummeted close to the costs of new gas-fired generation.

INVESTING IN UTILITIES

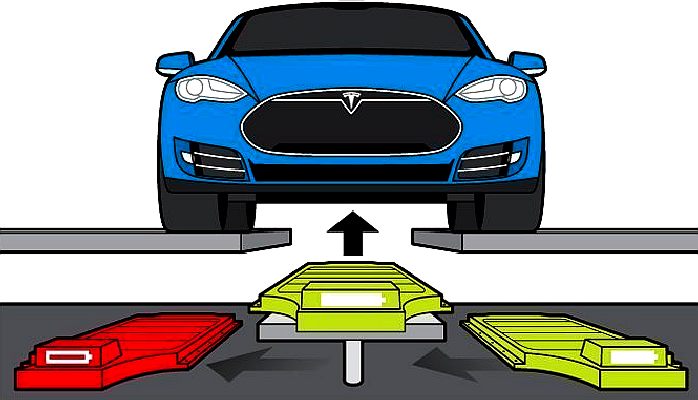

STATE OF THE NATIONS - There are a number of cartridge formats at the moment leading to a confused market, and confused motorists. Better Place kicked off with one system, Tesla stalled in 2013, NIO uses a similar under car mounted cartridge and BattSwap and PowerSwap use similar capacity cartridges, with PowerSwap being a side loading system. The point here is that with a standard cartridge, service stations can be provided to recharge trucks, vans and cars. At the moment there are no energy cartridges or service stations for heavy goods vehicles.

Networked flat pack service stations may be made available to any utility, supermarket or energy trading (brokers) company, but also entrepreneurs who might operate as independent franchises.

FROM SPACE EXPLORATION TO ZERO EMISSIONS - Developed to power satellites and spacecraft, the silicon solar panel is now a cost effective way of generating clean electricity. Ideal sites for the location of solar farms is land that cannot be used for farming, such as the deserts we have created.

Duke Energy Corporation, DUK, N. Carolina, USA Dominion Energy Inc., Richmond, Virginia Exelon Corporation EXC, Chicago, USA KEPCO Korean Electric Power Corporation National Electric Grid & Central Electricity Authority (India) National Energy Board (Canada) National Grid plc (formerly Central Electricity Generating Board UK) Next

Era Energy Inc. Florida, USA Southern Company, Atlanta, Alabama, Georgia, Mississippi, USA State Grid Corporation of China TEPCO Tokyo Electric Power Company

CONTACTS

PIC: 915580382

ENERGY GENERATING-DISTRIBUTION UTILITIES

- Audi - BMW - Citroen - Fiat - Ford - Lotus - Mercedes - Peugeot - Renault - Seat - Smart

MAKES OF ELECTRIC TRUCKS

- DAF - MAN - Renault - Volvo

MAKES OF ELECTRIC BUSES & COACHES

- BDY

LINKS & REFERENCE

https://www.enlit-europe.com/euw https://www.nrcan.gc.ca/science-data/data-analysis/energy-data-analysis/energy-facts/renewable-energy-facts/20069#L7 https://www.investopedia.com/articles/investing/022516/worlds-top-10-utility-companies.asp https://ec.europa.eu/digital-single-market/en/fet-proactive https://www.power-technology.com/features/top-10-power-companies-in-the-world/

Please use our A-Z INDEX to navigate this site

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This website is provided on a free basis as a public information service. copyright © Climate Change Trust 2022. Solar Studios, BN271RF, United Kingdom.

|